Travel Insurance with Cover-More

Vibrant Women Travel has compared several travel insurance providers to provide you with what we think is the best option in terms of travel insurance for our guests. We have worked with Cover-More during several emergency situations overseas and they have always been great in a crisis. Our clients also tell us they are prompt and efficient in their response to claims. It is of course up to you to do your due diligence in terms of choosing the best travel insurance to suit you. Vibrant Women Travel cannot answer any travel insurance related questions please contact the experts directly below. * Vibrant Women Travel cannot be held responsible for any false or misleading information provided by Cover-More nor can we be responsible for any decisions made regarding claims. We are merely making a suggestion based on past experience.

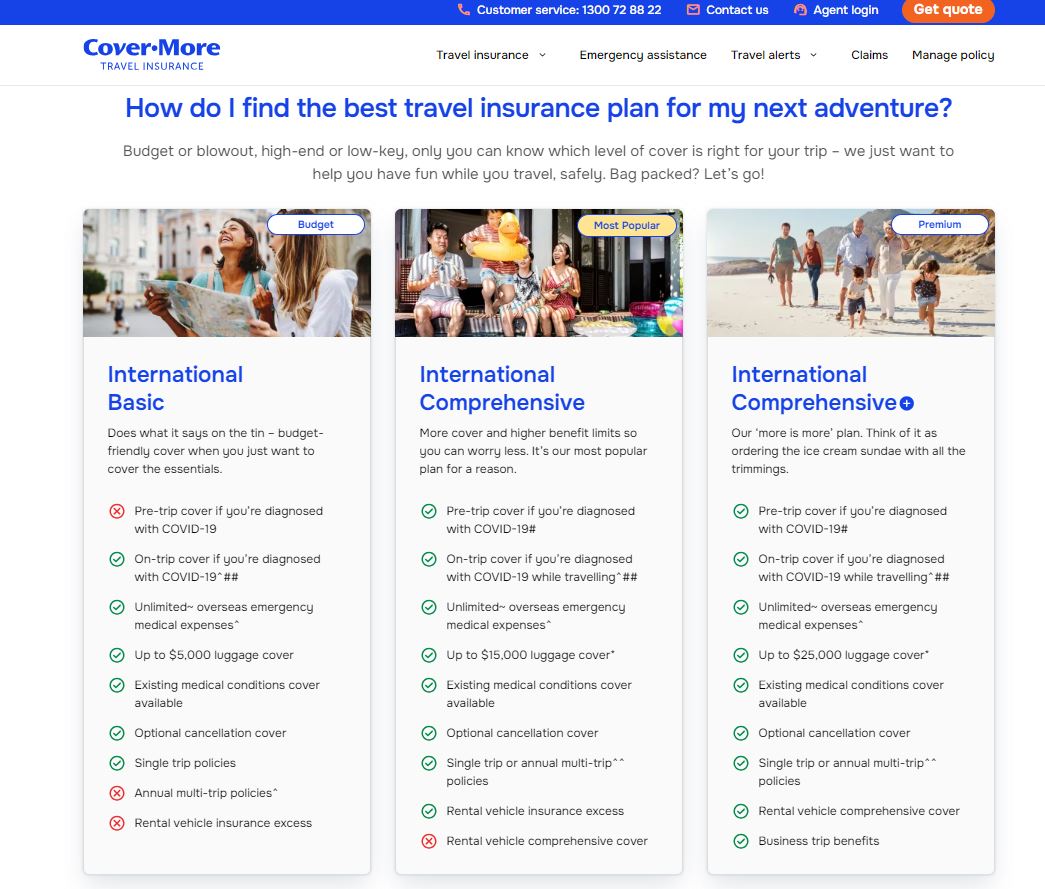

It is imperative that you read through the Insurance PDS (Product Disclosure Statement) to understand what is included in your policy and you need to be comfortable with the level of coverage provided.

When travelling with Vibrant Women Travel, travel insurance is mandatory.

*Please note Vibrant Women acts as a referrer only. If you buy the insurance we get commission of up to 10% on the premium less taxes and charges. We cannot and do not make any recommendation on the insurance product and whether it is right for you. You must do you own due diligence in terms of whether or not this insurance meets your needs. We have had good experience with Cover-More in the past and continue to recommend them to our guests. Vibrant Women will not be held responsible for any disputes arising from any claims or dissatisfaction with the policy. Please pay extra attention to sections on existing illness to ensure you are satisfactorily covered as well as for any activities that require risk. Note maximum payouts in circumstances such as delayed travel. Different levels of cover provide different protection. If in doubt contact Cover-More to discuss your needs.

**Vibrant Women cannot answer any questions about travel insurance, please contact Cover-More HERE if you have any questions.