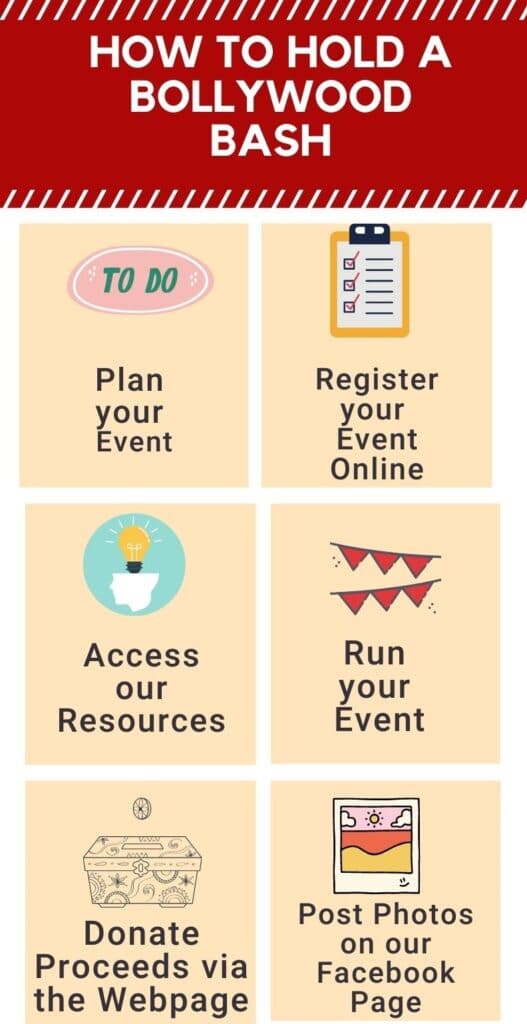

RESOURCES

Click the links below

60 Indian recipes that are second to naan

Best Hindi Movies of 2020 as rated by the Indian Times

Challenge people to an India trivia quiz

How to Plan a Successful Charity Event – EventBrite

How to Create a Facebook Event page

Shop for Indian Dress Up Costumes online

Use our Handy Fundraising Event Checklist

Bollywood Fundraiser Costing Spreadsheet

Running fundraising events

As Friends of Samadhan is a registered charity in Australia if you run a fundraising event your donors may be able to claim a portion of their contribution as a tax deduction. If your donor does not benefit from the donation, it may be tax-deductible as a gift. For example if you are selling tickets to an event where food is served, the cost of the food cannot be claimed, but monies in excess of that can. You must provide a receipt only for the claimable portion.

For your donors to be able to claim tax deductibility there are various conditions that must be met. The things you must do are:

Advise your donors if any parts of their contributions are tax deductible, and if so, how much (that is, let them know what the minor benefit is).

Provide your donors with receipts, including name of charity and ABN, FRIENDS OF SAMADHAN abn: 64457171160.

Comply with state, territory and local government fundraising requirements.